Eligible projects include:

- Loans and investments in operating businesses located qualified census tracts

- Development of commercial, industrial and retail real estate in qualified census tracts

- Mixed-use projects are okay where commercial income exceeds 20 percent of the gross income of the property

Potential benefits to businesses include:

- Provides gap financing for projects that would otherwise not be able to move forward

- The weighted average interest rate paid by the borrower is below market rate

- Advance rates on collateral exceeds market rate

- Business receives patient capital with some interest-only payments and longer than market amortization period.

- Some forgiveness of the “B Note” (net tax credit equity)likely depending on economic impact of project

Note that a significant portion of this area is also a part of the City's TIF 10, so additional incentives may be available for qualified projects.

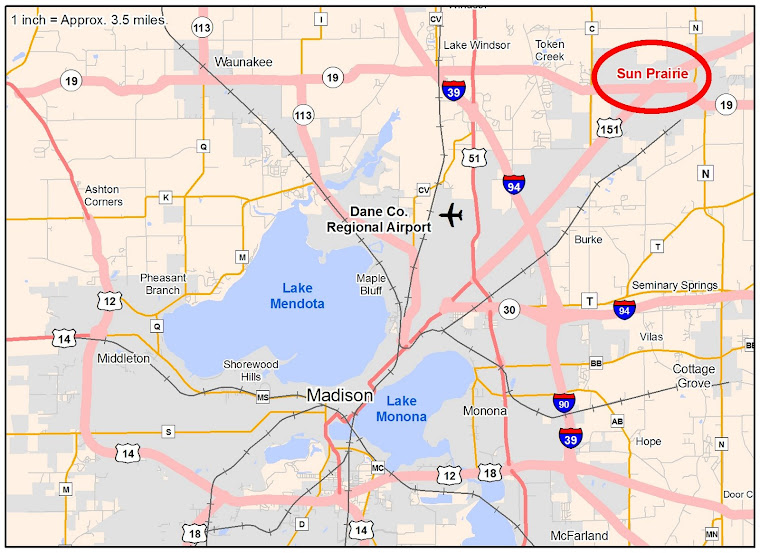

Note that a significant portion of this area is also a part of the City's TIF 10, so additional incentives may be available for qualified projects.For additional information or assistance in evaluating New Market Tax Credits for a project in this area, contact either of these financial consultants familiar with the qualified Sun Prairie tract:

Kate Crowley, Manager

Baker Tilly

608-240-6718

or

Carol Maria, President

Wisconsin Business Growth Fund, Inc.

262-436-3016

cmaria@wbd.org

No comments:

Post a Comment