Fitch Ratings assigns a rating of 'A+' to Wisconsin Public Power Inc. (WPPI) $234.685 million power supply system revenue bonds, series 2008A. Fitch also affirms the 'A+' on WPPI's outstanding power supply revenue bonds.

Fitch Ratings assigns a rating of 'A+' to Wisconsin Public Power Inc. (WPPI) $234.685 million power supply system revenue bonds, series 2008A. Fitch also affirms the 'A+' on WPPI's outstanding power supply revenue bonds.The 'A+' rating reflects WPPI's experienced management team which has the support of its growing member and non-member base. While there is some concentration among the largest industrial customers of the members (with the four largest accounting for 16% of energy requirements), helping to offset this is that many of the large customers have entered into long-term purchase power contracts with WPPI and its members, and more important, WPPI's competitive advantage - rates that are lower than those charged by the locally serving investor-owned utilities. Financial operations have been solid and projections show targeted debt service coverage of 1.25 times (x) through 2017, in line with other 'A+' rated systems. Another positive attribute is WPPI's power resource mix, which is diverse with sufficient capacity into 2017. The terms of the various power purchase contracts provide WPPI further flexibility.

Click here to read the full article at Businesswire.com, or the synopsis on the Capital Times web version of Market Memos for April 18th.

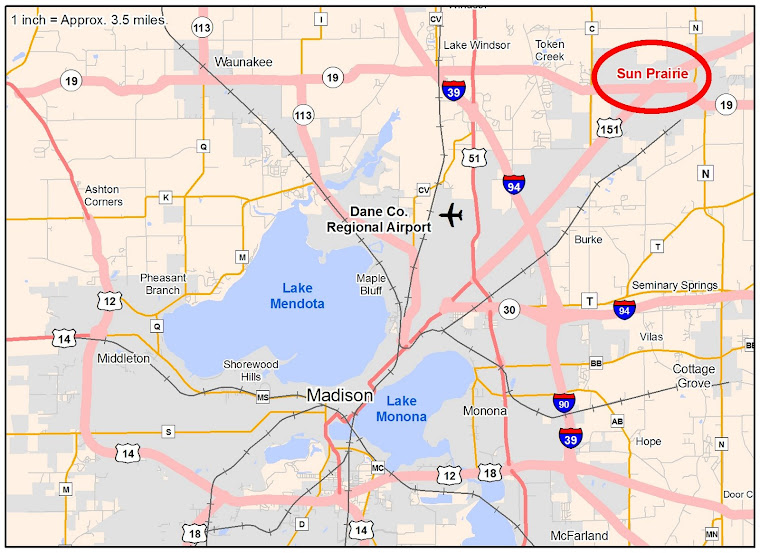

UPDATED: According to the Wisconsin State Journal's Business Digest for May 1, 2008, Standard & Poor's Ratings Services has upgraded its rating of Sun Prairie-based Wisconsin Public Power's outstanding parity debt to A+ from A and also assigned an A+ rating to the company's $235 million revenue bond issue. Fitch Ratings also has assigned an A+ rating to the revenue bonds while Moody's has rated them A1.

UPDATED: According to the Wisconsin State Journal's Business Digest for May 1, 2008, Standard & Poor's Ratings Services has upgraded its rating of Sun Prairie-based Wisconsin Public Power's outstanding parity debt to A+ from A and also assigned an A+ rating to the company's $235 million revenue bond issue. Fitch Ratings also has assigned an A+ rating to the revenue bonds while Moody's has rated them A1.

No comments:

Post a Comment